Florida Insurance Appeals: When Your Application Gets Denied

Moving to Florida is a fresh start for many. The sunshine, beaches, and new opportunities can feel like a dream come true. But then comes the reality check—figuring out your health insurance. If you’ve hit a wall with a denial, you’re not alone. Florida insurance denial appeal is something I’ve seen more times than I can count over my 11 years in the business.

Here’s the thing: getting denied coverage Florida-style isn’t the end of the road. It’s just a bump. But you need to know what to do next. That’s where the marketplace appeal process comes in. And trust me, it’s not as scary as it sounds.

Why Do Insurance Applications Get Denied in Florida?

Before you can fight back, it helps to understand why your application might have been rejected. Insurance rejection Florida cases often boil down to a few common issues:

- Missed Deadlines: Florida has specific windows for enrolling in health insurance through the marketplace. If you’re outside those dates without qualifying for a Special Enrollment Period, your application can get denied. Incomplete Information: Forgetting to verify your income or missing documents can stall your application. For example, failing to upload pay stubs or proof of Florida residency. Eligibility Problems: Sometimes the system flags you because you’re already insured elsewhere or your income doesn’t meet program criteria. Data Entry Errors: A simple typo in your Social Security number or birthdate can throw the whole thing off.

These reasons might feel frustrating, but they’re fixable. The marketplace appeal process exists to catch these mistakes and give you a second shot.

Understanding the Marketplace Appeal Process in Florida

Okay, you got your rejection letter. What now? First, don’t panic. The marketplace appeal process is your friend here. It lets you challenge the denial and explain your side.

Here’s how it typically works:

Here’s a real example. A client moved from Georgia to Florida in March but missed the marketplace open enrollment by a week. Their application got denied. We filed an appeal citing their change of address and new job start date as qualifying events. The appeal succeeded, and their plan started a month later.

Special Enrollment Periods Are Your Lifeline

One of the biggest confusions I see is around Special Enrollment Periods (SEPs). The truth is, moving states almost always qualifies you for an SEP. But only if you act fast.

When you move to Florida, you generally have 60 days from your move date to enroll in a new plan. This includes switching from out-of-state coverage or from no coverage at all.

Why does this matter? Because outside the SEP window, your application will likely be denied for missing the enrollment period.

Special Enrollment Period examples include:

- Relocating to Florida from another state Getting married or divorced Having a baby or adopting a child Losing other health coverage

Here’s a tip: when you start submitting your application, have proof of your move ready. A Florida driver’s license, lease agreement, or even a utility bill dated after your move can make or break your case.

Common Mistakes That Trigger Denials and How to Avoid Them

Look, I’ve seen clients miss out on coverage because of tiny errors that felt obvious after the fact. Here are some preventable pitfalls:

- Not Updating Your Address Everywhere: It sounds simple, but if your mailing address isn’t updated with Social Security, your employer, or on your application, the system can flag you. Ignoring Income Verification Requests: The marketplace often asks for proof of income. Sending incomplete or outdated documents can lead to denial. For example, submitting a 2020 tax return in 2024 won’t cut it. Missing the 60-Day SEP Window: The clock doesn’t stop. If you move on April 1st, your SEP ends on May 31st. No exceptions. Applying Too Early or Too Late: If you apply before your move or after your SEP expires, your coverage might be rejected.

One client submitted their Florida insurance application two days before their official move date. The system denied them because their Florida residency wasn’t recognized yet. We had to appeal and provide additional proof to get it sorted.

How to Prepare Your Appeal: Documentation Checklist

When dealing with a denied coverage Florida case, documentation is king. Here’s a checklist you can use:

- Proof of Florida residency: lease agreement, utility bills, driver’s license Proof of income: recent pay stubs, tax returns, Social Security benefits statements Proof of loss of previous coverage: termination letters, employer statements Personal identification: Social Security card, birth certificate Correspondence with the marketplace: denial letters, emails

Keep copies of everything. When you submit your appeal, attach a cover letter explaining your situation clearly. For example, “I moved to Florida on March 1st and applied within my 60-day SEP window. Attached are my lease agreement and first paycheck from my new job.”

Coverage Gap Prevention: Why You Can’t Afford to Delay

Here’s the truth: every day without health insurance risks your health and your finances. Coverage gaps can lead to unpaid medical bills and surprise expenses.

When you face an insurance rejection Florida situation, don’t wait weeks to appeal. Submit your appeal quickly to prevent gaps.

Also, look for short-term or transitional coverage if your appeal might take a while. Florida has limited short-term plans, but they can be a stopgap for a few months at prices around $347/month depending on age and health.

If you’re currently uninsured, clinics and hospitals may offer sliding-scale fees, but that’s not a substitute for insurance.

Dealing with Florida Insurance Companies: What to Expect

Florida’s insurance market includes big names like Florida Blue, Molina Healthcare, and Oscar Health. Each has its own quirks.

For example, Florida Blue tends to have a more straightforward appeal process, but turnaround times can be 30-60 days. Molina might request additional medical records or verification of income.

One annoying thing? Sometimes the marketplace and the insurance company won’t talk directly. You need to manage communications yourself. That’s why keeping detailed notes and copies of every call or email matters.

When to Get Professional Help

Look, you can handle a florida insurance denial appeal on your own, but it’s not always easy. If you’re confused about SEP deadlines or keep getting denied for unclear reasons, an insurance broker or navigator can save you time and stress.

For instance, I once helped a client avoid a two-month coverage gap by catching a missed SEP deadline and fast-tracking their appeal. That kind of insight comes from experience.

Also, if your denial involves complicated issues like Medicaid eligibility or disability, professional help can make a big difference.

Florida Insurance Appeals: A Summary of Your Next Steps

Here’s a quick recap to keep things clear:

Review your denial notice carefully. Check if you qualify for a Special Enrollment Period (usually 60 days from your move). Gather all relevant documents proving residency, income, and previous coverage. File your appeal within 60 days of the denial date. Consider temporary coverage options if your appeal will take time. Keep detailed records of all communications and documents. Ask for professional help if you’re stuck or need guidance.Frequently Asked Questions About Florida Insurance Denial Appeals

Q: How long does the Florida insurance denial appeal process take?

A: It varies, but typically you’ll get a decision within 60 to 90 days after filing your appeal. Some cases are faster if your situation is urgent.

Q: Can I get coverage retroactive to my move date if my appeal is approved?

A: Sometimes yes. If you appeal successfully, coverage can be backdated to your move date or the start of your Special Enrollment Period. This helps prevent coverage gaps.

Q: What if my appeal is denied again?

A: You have additional options like requesting a hearing before an administrative law judge or pursuing external review. It’s a good idea to get professional advice at this stage.

Q: Does moving within Florida qualify me for a Special Enrollment Period?

A: Usually no. SEPs for moves apply when you move from another state or out of your previous coverage area. Moving within Florida typically doesn’t trigger an SEP.

Q: What if I don’t have proof of Florida residency yet?

A: Use whatever you have—utility setup emails, lease agreements pending signatures, or affidavits. The marketplace often accepts multiple forms of proof during appeals.

Q: Can an insurance broker help with the appeal process?

A: Yes. Brokers can guide you through paperwork, deadlines, and communication with insurance companies and the marketplace. Some charge fees; others don’t, so ask upfront.

Q: How much does insurance cost in Florida after an appeal?

A: It depends on your income, age, and plan choice. For example, a 40-year-old might pay around $347/month for a Silver plan after subsidies. Costs vary widely.

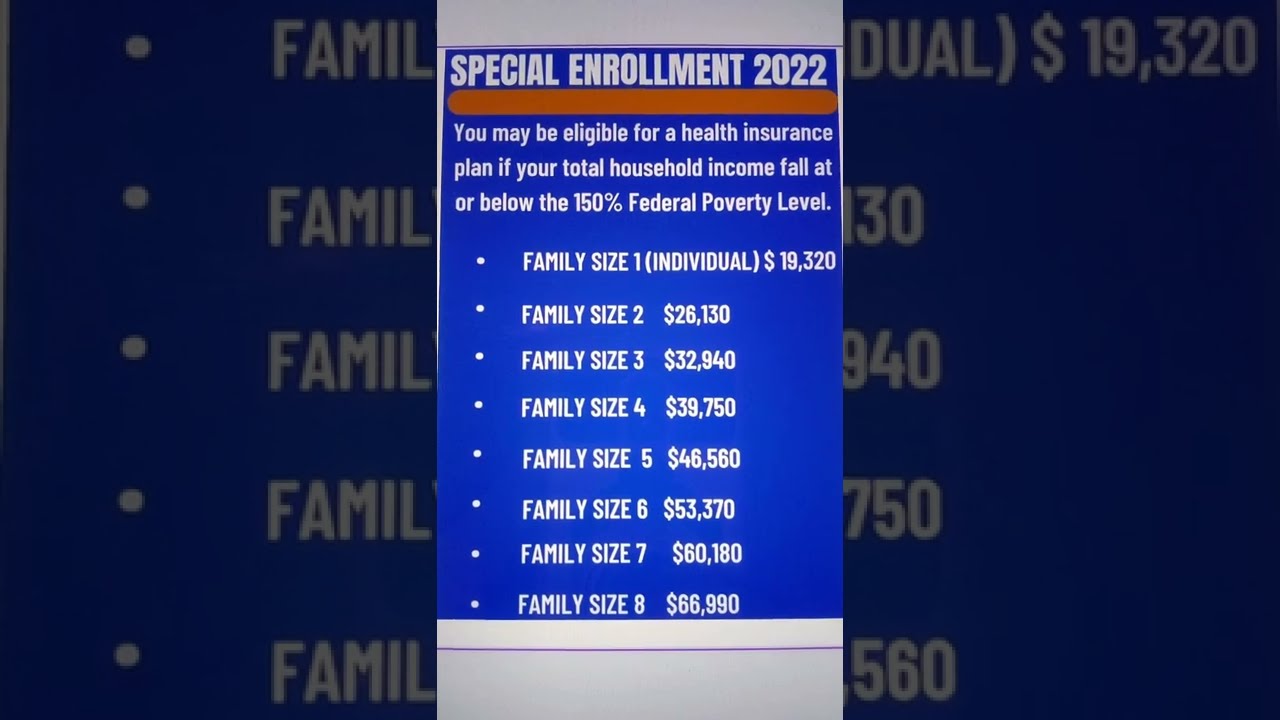

Q: Is Medicaid an option if my marketplace application is denied?

A: Possibly. Medicaid eligibility depends on your income and household size. You can apply at any time accessing healthcare marketplace in Florida in Florida. If denied, you can appeal those decisions too.

Q: What should I do if I lose coverage while waiting for an appeal decision?

A: Look for short-term plans or community health resources to cover urgent needs. Keep track of your appeal status and be ready to enroll once approved.

Q: Can I switch plans after winning an appeal?

A: If your appeal is successful, you typically get the plan you originally applied for. Changing plans outside of open enrollment or SEP windows isn’t usually allowed until the next enrollment period.

Final Thoughts

Getting a denial from Florida health insurance can feel like hitting a brick wall. But the marketplace appeal process is there to help you break through. With the right documents, quick action, and a clear understanding of Special Enrollment Periods, you can get back on track.

Don’t let a rejection stop you from protecting your health. Reach out for help if you need it. The clock is ticking, and your coverage matters.